Bond Traders Target Dovish Fed Pick as Rieder Favored

Futures traders are escalating wagers on a more aggressive Federal Reserve easing cycle, as markets increasingly price in the potential appointment of BlackRock Chief Investment Officer Rick Rieder as the next central bank chair.

Trading activity in interest-rate futures linked to the Secured Overnight Financing Rate (SOFR) and the fed funds rate has accelerated sharply, coinciding with a surge in Rieder’s odds in prediction markets. His probability has climbed to approximately 47%, surpassing former Fed Governor Kevin Warsh, following a reportedly positive interview with President Donald Trump.

Market participants perceive Rieder, a Wall Street veteran, as likely to advocate for a more dovish policy stance. "He would be dovish rates and likely press for three cuts this year," wrote Evercore ISI economists, citing his past public comments. Rieder has previously criticized the Fed's gradual quarter-point cut increments and its forward guidance, advocating instead for more decisive action.

Current interest rate swaps price in just under two quarter-point cuts for 2026. However, a wave of new positions in the SOFR options market reveals traders are betting on a much deeper easing cycle, with some targeting a fed funds rate as low as 1.5% by year-end—far below the prevailing market forecast.

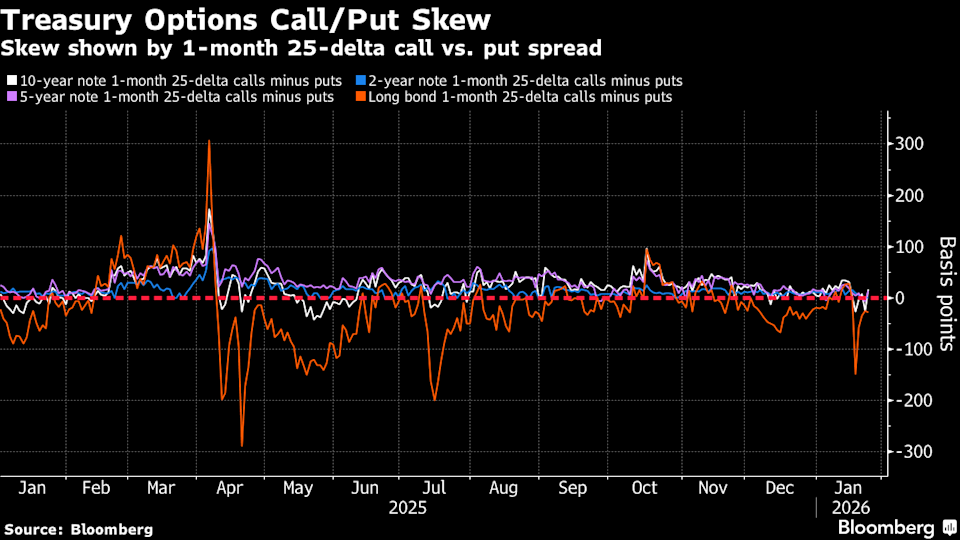

This positioning is evident in record trading volumes for specific contract spreads and a buildup of open interest at key option strikes, indicating concentrated bets on significant rate declines. While much of this trading is anonymous, the flows collectively signal growing conviction in a policy pivot.

Analysts caution that a Rieder-led Fed would still maintain independence. "His appointment is likely to bring credibility to the Fed chair and ease some market concerns," said Mohit Kumar, chief Europe strategist at Jefferies, noting Rieder is unlikely to be a "rubber stamp" for the White House.

The aggressive market positioning underscores how the speculation over leadership is becoming a dominant force in rate markets, with traders front-running a potential shift toward a more market-centric and accommodative monetary policy approach.